Research consistently shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The 2013 “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

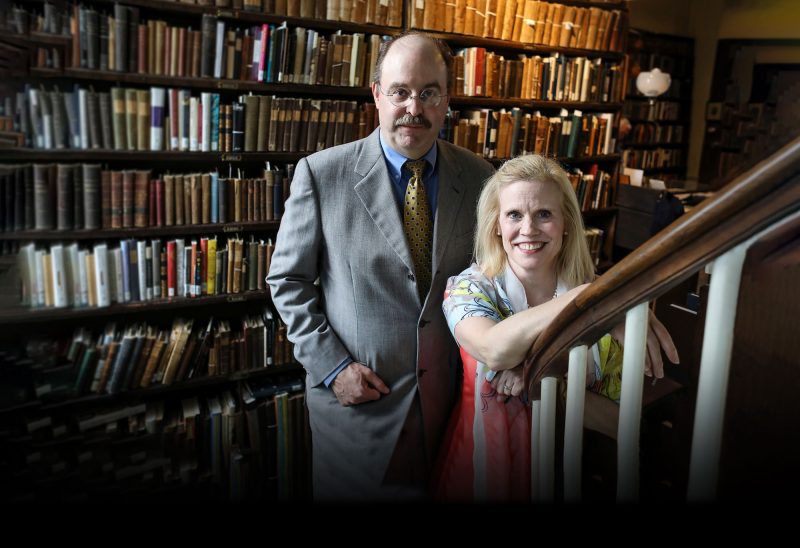

John Weeks is Managing Director of Family Wealth & Business Transition Planning at Harvest Capital in Concord. He serves on the Foundation’s Manchester Region Advisory Board.

He learned philanthropy first-hand, from his own family. As part of his practice, he helps business owners as they transition through the sale of their business. And philanthropy always comes up.

“As a wealth advisor you are looking to gain an understanding of what’s important to your clients,” Weeks said. “You look at the many surveys and studies done, and philanthropy always ranks as one of the top five things that are important to wealthy individuals.”

He starts the conversation from the basics: “Are there any causes that you are passionate about? Do you have a history of charitable giving?” And then, “We start incorporating some of the technical planning opportunities into our discussions, like pre-transaction gifting of their company stock and various tax benefits that may be realized.”

Philanthropy always ranks as one of the top five things that are important to wealthy individuals.

– John Weeks, Harvest CapitalTweet This

During a business ownership transition, Weeks helps people incorporate philanthropy into what is often a very complicated equation.

“Not only are they trying to figure out the technical aspects of transferring their shares and company ownership, but they are also transitioning to a new phase of their lives…so we want to help them map out all aspects of that transition. There’s a lot of moving parts that need to be sorted out and incorporated into this comprehensive plan,” he said.

“We spend a lot of time on the nuts and bolts of financial planning, but we try to spend as much time having the conversation with our clients about the softer topics: family relationships, their personal legacy, relationships with community – and philanthropy is one of those topics. It is very high on their priority list of where they find fulfillment and what they want to continue doing after selling their business.”

Faced with the complexities of selling a business, it can be hard to also think about specific philanthropic goals. In a recent conversation, clients of Weeks said they were “’Interested and committed to doing something – we just haven’t had the time to figure anything out.’” Weeks talked to them about donor-advised funds. A gift can be made to a donor-advised fund, but specific grant-making decisions do not have to be made right away. Which, he said, gives people “the tax benefit right away, and the time to figure out what organizations to support once they’re ready to exhale. All you have to think about is how much to give and the most tax-advantaged year in which to do it. You don’t need to worry right now about exactly where all that money is going to go.”

“It’s a value-add that we’re bringing it up, and they’re appreciating our proactive approach.”

Weeks also helps clients see past the business transition. For many, the answer to the “what’s the next chapter?” question includes a deeper involvement with philanthropy. Advisors can help people map out how to give with the most impact and meaning.

“Many are looking at their next adventure, and their next adventure might include being more involved with nonprofits, taking advantage of the extra time available following a sale. So that gets us talking about ways they could accomplish those things, whether it’s identifying organizations that match their interests, serving on a governing board or finding the best way to provide financial support,” Weeks said. And that helps him understand his clients on a much more personal level and address what is most important to them.

Philanthropy, he said, is also a place where values are passed through generations. “We’re talking about a lot of life-fulfillment-type stuff with these people, and when we start talking about philanthropy and the intergenerational connection, they light up.” He helps clients involve their children in giving. “We talk about how philanthropy can be a great rallying point for the family to get together and talk about their values and what’s important to them. It really opens up those conversations and provides a platform for these discussions,” he said.

Weeks sees philanthropy not as an “add-on” to the discussion with his clients, but as an important component of the whole.

“So of course we’re talking about it,” he said. “It’s an important piece of this complex puzzle that we are trying to make sure all fits together seamlessly for our clients.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)