Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The U.S. Trust Study of the Philanthropic Conversation, conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. The study also suggests that advisors should talk about their own charitable giving with their clients. And nearly one-third of people said that they would be more likely to choose an advisor who is knowledgeable about charitable giving.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

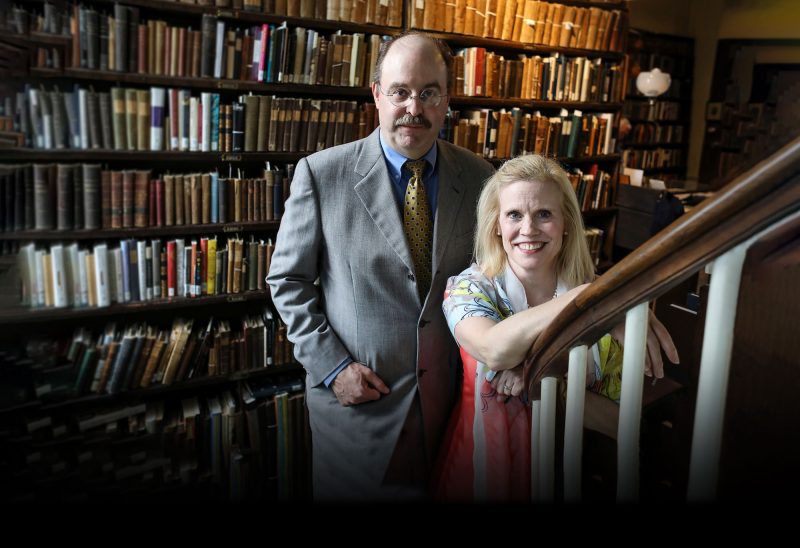

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

Andrea Sennott is a partner at Robinson, Boesch, Sennott & Masse in Portsmouth, where she concentrates on estate planning, probate administration and elder law. She has been named to the “Best Lawyers in New Hampshire” list in elder law and estate planning. She also serves on the Charitable Foundation’s advisory board for the Piscataqua Region.

Sennott is always comfortable talking about philanthropy. She learned about philanthropy from her parents, who took the teachings of their Catholic faith about charity seriously — and who have a creative streak.

She tells this story:

It was Christmastime, just after she and her brother had both gotten their drivers’ licenses. Their parents sent them each on an elaborate scavenger hunt. Clues led them to the homes of friends and neighbors. At each stop, they collected a wrapped gift, which they were strictly instructed not to open — and given a clue leading them to the next gift.

For Andrea, the last stop on the scavenger hunt was a battered women’s shelter, where her mother was waiting. They delivered all the packages to the shelter together. Her brother’s last stop was a homeless shelter, where their father was waiting to help deliver his packages.

“My parents were always very involved with St. Vincent De Paul and other things. It wasn’t about them writing big checks,” she said, “but just helping people in the community.”

“Philanthropy and charitable giving is something that I am passionate about. For me, there has never been any formal training about ‘this is how you talk to your estate planning clients about charitable giving’ but it’s just something I enjoy talking about, and we have natural conversations about it.”

She does not hesitate to talk about her own family — past and present — and how they have incorporated philanthropy into their estate plans. And she said it is a natural thing to make charitable giving part of the conversation with clients from the start.

“I just try to make it matter-of-fact,” she said. “I am asking ‘What are your kids’ names? Where do they live? Does anybody have any special needs? What charities or church are important to you that you give to?’ And almost everybody has something, whether it’s the $5 or $10 they put in the basket at church every week, or their local library — they almost all have something that they give to…Then when we get to talking about the actual plan, I already know or have a sense of what is important to them.”

Her clients, she said, are proud to be able to include philanthropy in their estate plans, and feel good about doing so.

“They feel like there is a purpose and I think it is a fun thing. Some people are very private and they don’t want anybody to know about it, and others want to tell everybody and share their story of giving and encourage other people to do the same thing,” she said. “And there are people who say ‘no I am not interested in that right now,’ and that is perfectly okay also.”

Sennott helps people craft plans that work for them.

Some have created plans that divide assets among their children — in staggered distributions, and with a charitable provision built in.

“The kids get a certain amount immediately, and then they get another percentage five years later and ten years later,” Sennott explained. “But when they come back for their second distribution — this is part of the trust — they have to show the trustee that they have given a certain percentage of what they received from the parents to a charity of their choice. They wanted to give the kids a chance to really think about it. It gives them time to do research and decide what they are passionate about and who they want to give to.”

What is important for people to understand, she said, is that such plans mean that the tax benefits also accrue to the children, since they are the ones actually giving the money to charities.

Another family, she said, decided to distribute their assets among their three children — creating scholarships named for each at their alma maters.

Sennott calls on the Charitable Foundation to help clients structure their giving.

“Some clients will know they want to make a donation and may have an idea of the types of organizations that are important to them, but they don’t necessarily know how they want that structured or which nonprofit they want to work with, so I encourage them to talk to the Charitable Foundation,” she said. Some set up donor-advised funds while they are alive, she said, and then make provisions to add to those funds from their estates.

One woman, who lived in New Hampshire but had a deep connection to a community in Maine where many families struggled to afford college, set up a scholarship at the Charitable Foundation to help kids from that community get an education that would help them get ahead.

And when clients get in touch to update her with any changes to their plans, Sennott makes sure to review the charitable segments to ensure that they are similarly up-to-date.

Sennott encourages colleagues to get comfortable having conversations about charitable giving. Compared to some of the other things they discuss with clients, she sees philanthropy as an easy topic to discuss.

“We are asking our clients about all sorts of confidential information: how much money do you make? Where is your money invested, how many kids do you have from your first marriage? They tell us the nitty and gritty about their families. So I think they are happy to talk about charities. If you can have those conversations, this should be an easy one.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)