Research consistently shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The 2013 “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

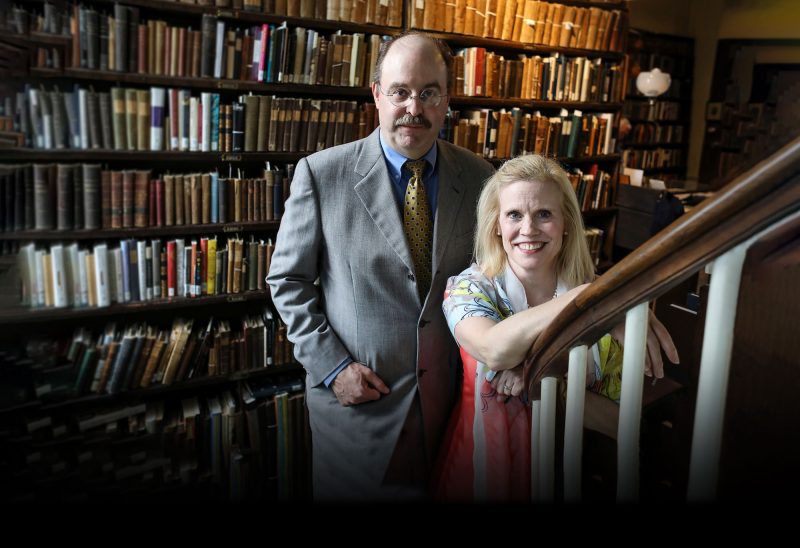

Alexandra Breed is an attorney who chairs the Trusts & Estates Department at McLane Middleton. She is also a member of the Foundation’s Lakes Region Advisory Board, which informs and advises the Foundation’s grant making and work in the Lakes Region.

Breed listens carefully to her clients’ needs and circumstances, and generally mentions charitable giving as she explores the clients’ estate planning goals. She talks to them about what matters to them as they plan their estates, asking questions like “What do you want to do with the money, who do you want it to benefit, what control do you want to have over it? If you are going to create a donor-advised fund, what is the purpose of the fund and who do you want to have be the successor advisors?”

And then she reaches for the right tools to help – often engaging the Foundation as a philanthropic partner for her clients.

“The people there are knowledgeable and professional and they deal with both sides of the equation: the folks who want the money and the folks who give away the money,” she said, “and their skill set is to put together a program.”

One client, she said, was administering a small, private family foundation. The work was overly complex for the size of the fund, and the client was concerned that foundation’s assets were not being invested in the most beneficial way.

“The whole process of running this thing was a great deal of fun but somewhat problematic,” Breed said. Her client decided to transfer the assets into a donor-advised fund at the Foundation. The Foundation invests the assets and administers the fund, and the fund-holder makes recommendations for how grants are distributed.

“Another client came to us because he was going to experience a taxable event, and did not know what to do with his estate. I was able to put him in touch with the Charitable Foundation and they took it from there.” He is now supporting environmental education and the construction of hiking trails, and “is very excited about the activities he is supporting.” She has a client who set up a fund to support her town conservation commission and library and another interested in establishing a scholarship.

The conversations that happen as such plans come together, she said can engage the entire family and pass on philanthropic values and traditions to the next generation.

“What better way to do it than to have the ability to sit down with somebody from the Foundation who is knowledgeable, and get some ideas? If you want to be involved in the state and a community, what better way to do it?”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Richard Peck, Foundation vice president of development and philanthropy services, at 800-464-6641 ext. 265 or Evpuneq.Crpx@aups.bet.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)