Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The U.S. Trust Study of the Philanthropic Conversation, conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. The study also suggests that advisors should talk about their own charitable giving with their clients. And nearly one-third of people said that they would be more likely to choose an advisor who is knowledgeable about charitable giving.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

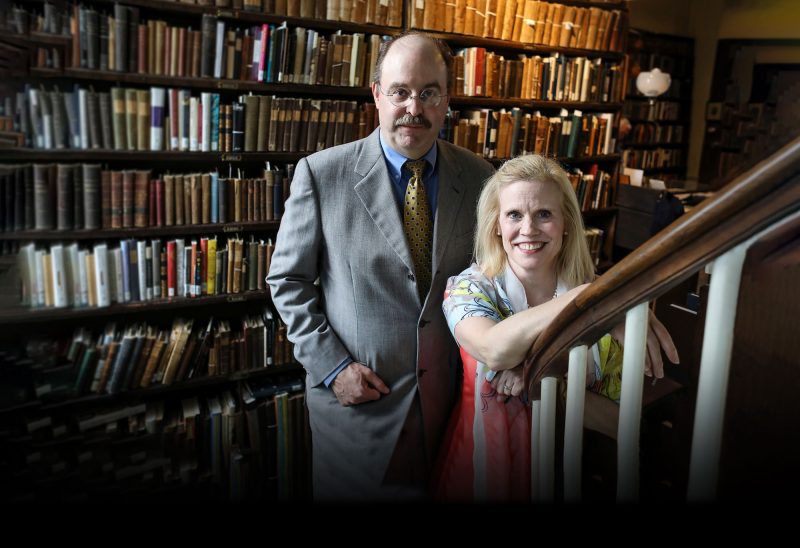

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

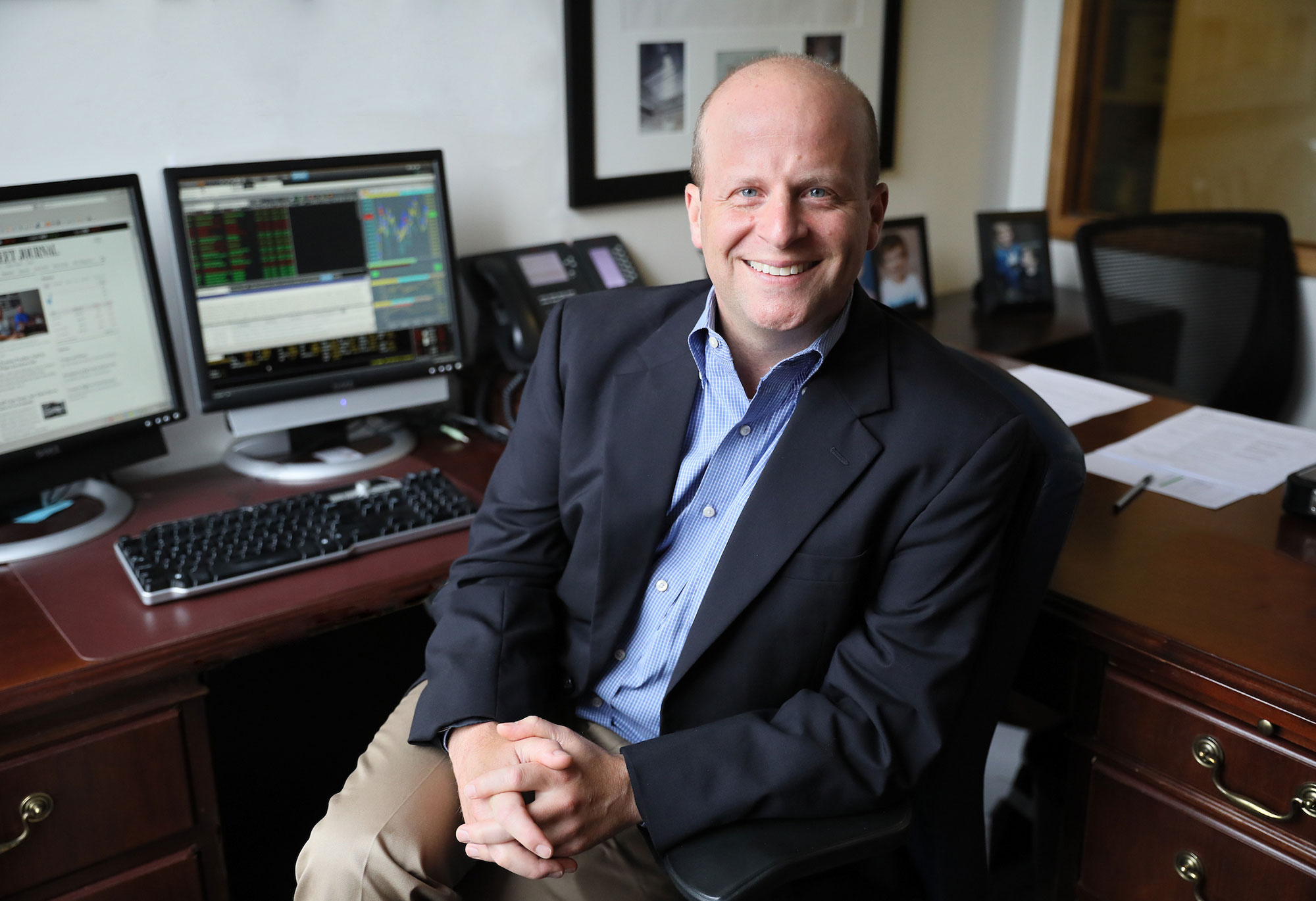

Adam Ruedig of Portsmouth is a registered investment advisor and vice president for wealth management at the Ruedig Group of UBS Financial Services. He serves on the board of directors of the nonprofit Portsmouth Housing Authority, and has also served on the boards of 3S Artspace and Red River Theatres.

Because every conversation is unique to a client’s particular circumstance, philanthropy comes into the planning process at different times for different people. But Ruedig sees common threads among the people he works with. Among them, that Baby Boomers are looking at philanthropy — along with being able to take care of their families and travel in retirement — as a benefit of a life of hard work.

“I think it’s the Baby Boomer zeitgeist,” Ruedig said, “For many folks, a reward for a life of hard work is giving back to the community. People might say ‘I have been waiting all of my life to really support this organization in a much bigger way.’ It is a little bit of a reward for working hard, for success — being able to really step up and have an impact on a cause or in a community.

“Talking about how the fruit of a lifetime of work, or in some cases generations of work, really impacts the well-being of your family or your community — that is a meaningful conversation. This is a very enjoyable part of our work, because you are going beyond the numbers to what is really important to people,” he said.

Philanthropy is part of Ruedig’s integrated approach. “The most well-crafted strategy can be a failure if it doesn’t contribute to comfort and satisfaction in life,” he said. “And that often means discussing philanthropy.”

Philanthropy brings immeasurable satisfaction to people, he said — whether they have a little to give, or a lot.

“It is equally meaningful for people that are giving really significant, organization-changing gifts or people that are giving smaller annual gifts that are big in their own financial worlds,” he said. Which is why it is always important to talk about. “Part of the value that we can bring is understanding that there are efficient ways to structure your philanthropy that will enhance what you want do. It can be a tool for managing financial puzzles: taxes, concentrated assets, illiquid assets…”

His experience of working with multiple generations of families led him to an understanding that is different from the common narrative around families and wealth.

“In the popular press, there is an idea that children that inherit significant wealth don’t have to take on the same responsibilities that other folks do. But we find that exactly the opposite is true: that second and third generations take the responsibility of the legacy of family values very seriously. And developing a strategy and understanding how the next generation can really take an active role in a family’s philanthropy and legacy is an exciting challenge.” Working with generations to collaborate on philanthropy, he said, “gives some peace of mind to older generations, because, by working together, they know those values are going to continue.”

Ruedig embraces the opportunity to work with a person’s entire team of advisors — including attorneys and CPAs — on their philanthropic planning.

“The work you do becomes better for that collaboration — and we consider the Charitable Foundation to be on par with those other advisors,” in helping put together strategies to simplify giving and maximize its impact.

The Ruedig Group was the first to partner with the Foundation on the advisor-managed investment option (formerly called individually managed fund) – a process which allows charitable resources donated to the Foundation to continue to be managed by an outside advisor.

“What advisors should know is that, in addition to being able to remain involved in the management of the assets, it’s really enjoyable and satisfying to be managing the asset in collaboration with the Charitable Foundation,” Ruedig said.

Ruedig recently introduced a client to the Charitable Foundation who had just moved to New Hampshire.

“She has a philanthropic interest, and so we recommended a donor-advised fund at the Charitable Foundation, because this was a great way for her to quickly get engaged in a new community,” he said. She has been meeting with Foundation staff to learn about New Hampshire nonprofits working on women’s issues, which is an area where she wants to make a difference.

“Without the resource of the Charitable Foundation, it would be much more difficult for her to understand the most impactful way to plug into supporting women’s issues in New Hampshire,” Ruedig said. “People from the Charitable Foundation know all of the organizations in state that support different causes. They are a great source of information for how to give with the most impact.”

Ultimately, Ruedig said, advisors should know that being able to help clients with philanthropy is an important part of the job – and adds depth and meaning to the work.

“If you’re going to do a great job for your clients, then you’re going to eventually step beyond the numbers and the analytical side of your work and talk about what really is important to them,” Ruedig said. “About why does their wealth improve their lives? And in almost every case, that is going to involve a discussion about philanthropy. We find that, as we talk to our clients about this, what we do for them becomes much more valuable. Our relationships become closer and more fun, and our day-to-day work becomes more meaningful.”

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)