Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

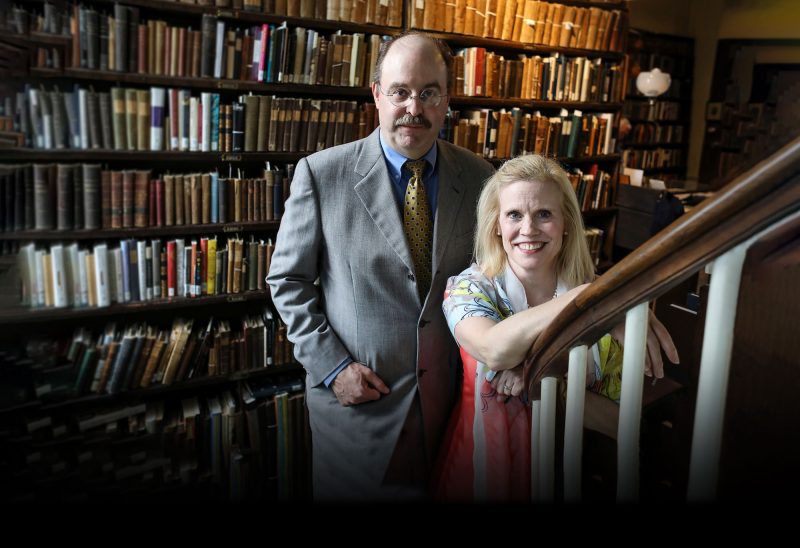

Dennis Ryan was a partner at Howe, Riley & Howe in Bedford for 33 years and now is an advisor to that firm. He is a CPA who provides clients with audit and accounting, tax and financial consulting services. Ryan also serves on the Charitable Foundation’s Manchester Region Advisory Board, helping to advise the Foundation’s grantmaking in the Manchester area.

For Ryan, conversations about charitable giving usually happen after he has gotten a chance to know a client a little bit — and often end up making that relationship more meaningful.

“In my business, it just really depends on the client — I don’t necessarily go into a conversation expecting to make that the first or second thing I talk about,” he said. “I have to get comfortable with a client and make sure they are comfortable with me. I am not pushy about it — charitable giving is a very personal decision.”

He said that he is seeing increased interest in and commitment to charitable giving — especially among younger clients and those with an entrepreneurial mindset.

“I find that it’s different than it was 15 or 20 years ago,” he said. “People these days tend to prioritize charitable giving a little bit more.”

He attributes some of that to very public examples set by high-profile people who have made giving a touchstone in their own lives.

“The Mark Zuckerbergs and Priscilla Chans of the world, the Bill and Melinda Gates and the Warren Buffets of the world — who have said ‘We have got enough money, we are going to give a vast part of our fortune away.’ It’s not as private as it used to be, and in that regard, that is a good thing,” he said. “I think that influences the young entrepreneurs.” He points to the Entrepreneurs’ Fund of New Hampshire as a local example of a group of people with “a desire there to carve out a little bit of their fortune, if you will,” to give to create a legacy to help others.

He has also noticed an increased commitment to volunteer among his younger clients and colleagues.

“I find that the younger people today are more willing to get involved in charitable ventures mostly by volunteering their time,” he said. “I see that closer to the top of their list than maybe it was a few years ago.”

Ryan’s own involvement with nonprofits, and his vantage point as part of the committee that advises the Charitable Foundation’s grantmaking in the Manchester area, has given him a deeper knowledge of community needs that informs his conversation with clients. Visiting nonprofit organizations and seeing the work first-hand, “makes an impression on you,” he said. “That’s how these discussions tend to start with clients or other people that you know — you just happen to have learned about Girls at Work or the Boys and Girls Club or the YMCA and you have seen what transformation can happen for kids,” who are part of such programs, he said. “You just want to talk about it.”

Ryan has always said that tax benefits are a secondary consideration for most people who want to give.

As is true for most people who give[i] Ryan said that, for the vast majority of people he works with, “it is more about their desire to help and to get involved…and then they’ll say ‘What is that going to do for me tax-wise? It’s almost never the other way around. I really do believe, honestly, that a really good percentage of people think about the contributions first and then the savings second.”

A number of Ryan’s clients work with the Charitable Foundation on their giving.

One was committed to giving a percentage of his company’s profits to charity each year. But by time the calculations could be made, at year’s end, giving decisions were often rushed.

“Every year we would get together in December, and you’re scrambling,” Ryan said. “We sat down with a couple people from the Charitable Foundation,” Ryan said, and his client opened a donor-advised fund. “The whole idea of a DAF was perfect for him,” Ryan said. “If you’re going to give a significant amount of money, you can put it into your DAF and take your time and evaluate where you want to give the money rather than doing it under the gun.”

The Foundation has helped his client understand the needs in the state and make solid decisions about how to help. “The people there have their finger on the pulse of what is going on,” Ryan said. “They know the state and they know where the needs are the greatest not only within a specific cause but in specific regions…and they know their donors and the people who have set up donor-advised funds,” he said, and are willing to bring funding opportunities to them.

“That is a service that is truly invaluable in my mind,” he said. “I think the Charitable Foundation is one of the greatest assets of the state of New Hampshire, as far as I am concerned.”

Ryan points out the advisor-managed investment option (formerly called individually managed fund) that is now offered by the Foundation, which allows people to set up charitable funds while keeping the assets under the management of their own wealth managers. “The fact that the Foundation has moved in the direction of becoming a partner with investment advisors is a great idea,” he said.

Ryan said that many people want to give, and yearn for the fulfillment that comes with giving and being involved with their communities — but they are just not sure how. He often suggests that people volunteer in addition to giving.

“Get in there and donate your time, and see how the thing runs,” he said. “When you talk about things like this, it becomes less clinical — your relationship with your client becomes more personal.”

For Ryan, talking with people about charitable giving is “just the right thing to do. If you know there are needs out there and you have seen how different organizations work to help people, you spread the news a little bit. It starts really simply with that.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.

[i] See the 2016 U.S. Trust Study of High Net Worth Philanthropy, conducted in partnership with the Indiana University Lilly Family School of Philanthropy

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)