Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

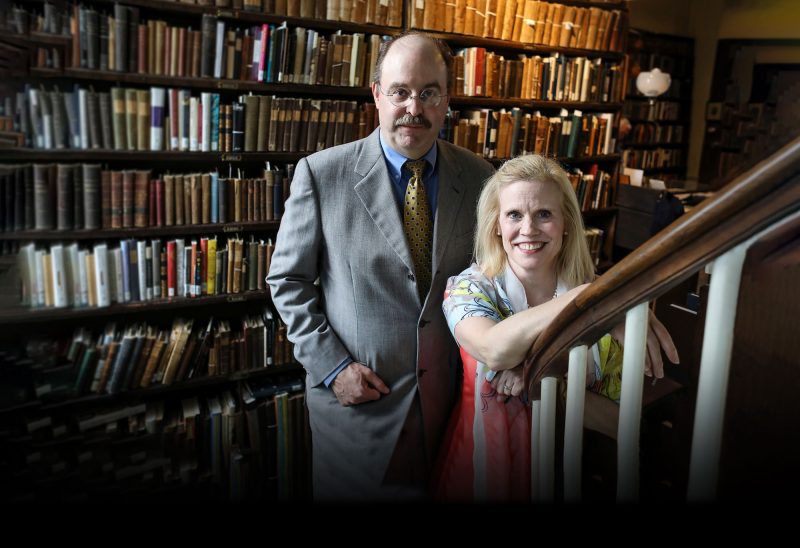

Tim Caldwell focuses on estate planning and settlement at Caldwell Law in Hanover. He is a former board member and chair of the Upper Valley Planned Giving Council, and was instrumental in establishing LeaveALegacy®NH/VT which offers training, support, and networking opportunities for gift planners. (He is also a four-time Olympic competitor in cross-country skiing — but that is another story.)

Caldwell, who serves on the Charitable Foundation’s Upper Valley regional advisory board, asks clients about their charitable interests from the very start.

“A huge percentage of the population supports charities — whether they have a lot of money or not,” he said. So it is incumbent upon their estate planners to “understand why, and what they might be trying to accomplish.”

His firm’s intake process includes an initial question about what charities people support and how important charitable giving is to their estate planning.

Caldwell then follows up with a more in-depth conversation, as part of the much broader planning process.

It is critical, he said, to “let the clients articulate what it is they really want without jumping in with a solution. The solutions really need to be driven by what the clients have articulated.”

Once he determines what a client wants to accomplish with charitable giving, he starts to discuss the methods and vehicles for accomplishing their goals. He helps people understand what can be done, citing examples and hypotheticals.

Listening, always, is key.

“We try to ask some open-ended questions, Caldwell said. “We are getting better at listening. The goal is to have a relationship and hear what the clients are thinking.”

Once you can discern the purpose that drives people to be charitable, you can help them to find increased joy and meaning in that enterprise.

A recent client worked through the Foundation to have a significant impact on a land conservation project. “They came in and were so delighted about the work they had been doing with land conservation,” Caldwell said. “They were just tickled that they have been able to have such a positive impact in their community.”

Caldwell frequently calls on the Foundation as a philanthropic partner. Many of his clients choose to use donor-advised funds to direct their current giving and to leave a legacy.

“You can engage your family with a donor-advised fund, you have the Foundation administering the fund, so don’t have to worry about the administrative details that go along with a private foundation, and you have a lot of flexibility. It can benefit a range of charities…It can accept many, many types of assets.”

To others who are working on the best way to talk about philanthropy with their clients, Caldwell suggests “just being pretty consistent.”

“It’s not a forced question,” he said. “If you’re not comfortable saying ‘what are the charities you have supported?’ say ‘are there charities you have supported that you feel passionate about and want to support in your planning?’”

Often, he said, simple solutions are the ones that work.

“The planning does not have to include a lot of bells and whistles, it can be a very straightforward gift,” he said. “We have more complicated solutions, and sometimes they totally fit the bill,” he said. But “for every charitable remainder trust that we help people with, we probably have 30 outright testamentary gifts. I think the clients really appreciate the advisor that comes up with simple solutions that are effective.”

Giving, Caldwell said, “is important to many people. And if we go in there not exploring that part of their lives, I think we have, in the end, done them a disservice.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)