Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

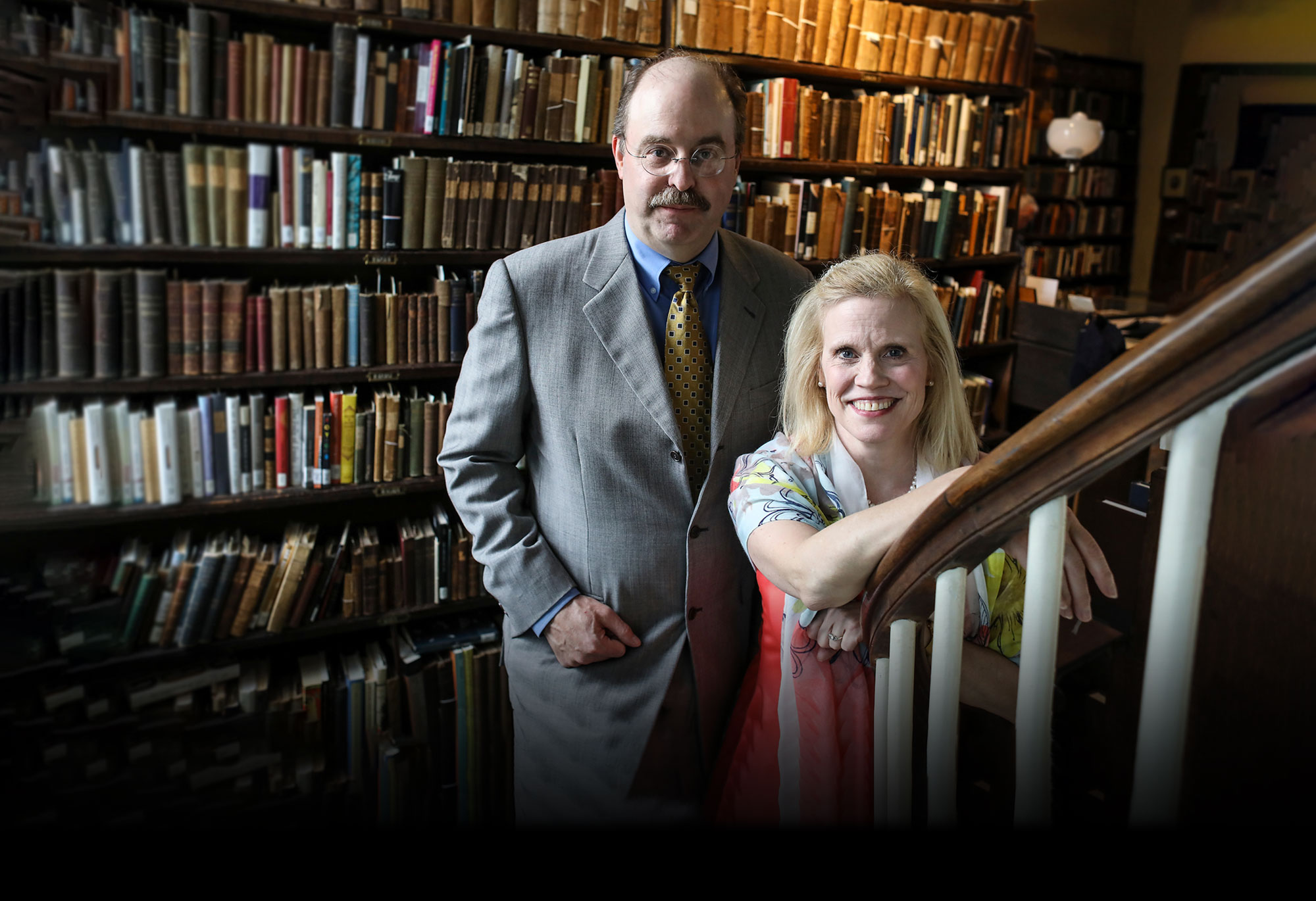

Sally and David Mulhern are founding partners in the law firm Mulhern & Scott, PLLC in Portsmouth, where they focus on sophisticated estate planning.

Sally is a fellow of the American College of Trust and Estate Counsel, and has been selected as one of US News & World Report’s Best Lawyers in America. She is also a member of Outstanding Lawyers of America and the Bar Register of Preeminent Women Lawyers. She is the author of “Estate Planning To Die For®: An Insider’s Guide For Financial Professionals.”

David leads Mulhern & Scott’s trust department, and routinely serves as a trustee, and in other fiduciary capacities, for the firm’s estate planning clients. He is nationally recognized for expertise in inter-generational estate planning and creditor protection and has been selected by his peers as one of US News & World Report’s Best Lawyers in America. The Mulherns’ son James, who is studying at Cornell Law School, plans to join his parents’ practice.

The Mulherns work to help many clients incorporate charitable giving into their estate plans.

The timing of that conversation, they agreed, is as varied as the clients they see — but often comes after they have been working with people for some time and gotten to know them well.

When they do talk about charitable giving as part of an overall estate plan, Sally said, they leave solutions aside at first, and talk about goals.

“It’s very important when talking with individuals who may have a charitable interest to focus on ‘what are you trying to accomplish?’” Sally said. Some will mention a cause they want to support and say “‘I want to set up my own charitable foundation.’ And I say, ‘well, let’s talk about that. That’s a solution. What are we trying to accomplish? And we find out that what they really want is to provide funds for some particular purpose.”

Sally often calls upon the Charitable Foundation as a resource for her clients. In this case, she would suggest to them a donor-advised fund.

“So rather than setting up your own foundation, which is expensive to establish and really doesn’t have the tax advantages that you might think, let’s explore the New Hampshire Charitable Foundation,” she said. “Rather than setting up your own 501c3, you can set up your own donor-advised fund, which allows you to have a tremendous amount of input” into how the funds are distributed, while avoiding the expense and administrative burdens of running a private foundation. She likes the flexibility and efficiency the model offers. And, she said, those funds are a great tool for including the next generation in giving — as children become successor advisors to the funds.

Part of her work is education, and part is guidance. Educating people about the estate-planning benefits of giving and then guiding them on which are the best assets to use.

“Retirement accounts are the most heavily-taxed assets,” she said — which makes them an excellent asset to consider for a charitable gift.

Sally and David Mulhern on focusing first on goals (before solutions), the benefits of giving as part of a complex estate plan, and why active listening is key.Tweet This

The Mulherns said that, for the high net-worth clients with whom they work, it is imperative to break the estate planning process into digestible stages.

“Because charitable planning is a complex, detailed, even arcane area of the law,” David said, “I think it’s too much to throw that into the mix as they are trying to get the fundamentals in place.”

“It has to percolate for a while,” Sally agreed. “Partially because the more sophisticated opportunities for charitable planning are something they need more time to understand.”

Sally said that active listening from the earliest meetings is critical to helping clients achieve their charitable goals. “If they raise it in their conversation, even as a secondary thought, you have to listen very carefully because you have to sometimes help clients identify their goals” as the process unfolds, she said. For people without children or natural beneficiaries, she said, she always asks about charitable giving as an option.

Estate planning, the Mulherns said, is best achieved by a team. They work with financial advisors, insurance experts, accountants and others.

“Getting New Hampshire Charitable Foundation representatives involved as part of that team I find to be really crucial as early on as possible,” Sally said. She frequently calls on the Charitable Foundation to do modeling of different options for charitable giving. “If a client is thinking about setting up a charitable remainder trust, I will call up and say ‘can you run me a model? If the client puts this amount in with this tax basis and withdraws a stream of income at 6 or 8 percent, what does their deduction look like? And that’s invaluable.”

Sally said that most of her clients who include charitable giving in their estate plans end up also doing more giving during their lifetimes. “They want to see some of that good being done while they are alive,” she said.

The Mulherns also enjoy seeing the good that is being done. One client’s bequest meant a huge boost for medical research at a prominent institution. Others have made significant gifts to the University of New Hampshire, to New Hampshire Public Television, to create conservation easements that protect open space.

“I love doing charitable planning with clients! It’s such a joy to see what they can do,” Sally said.

One of her clients is working on leaving land for public use.

“He said, ‘I hope someday you can be looking at this parcel of land when it’s a park and you will be able to take your grandchildren there.’ I feel so blessed to be able to play any part in all the charitable giving that goes on in this area.”

Law schools teach the technicalities and the tools, but not how to have the conversations, Sally said.

“You have to sit at the knee of an experienced lawyer,” Sally said, “It’s a matter of seeing how the person asks the right questions and listens not only to the answer but how they answer or what they list first in their answer. It takes time, but it’s a really important skill.”

But not being an expert is not a reason to avoid the conversation, David said.

“You don’t have to know everything about this by any means. There are many people that will work with you to help you to develop the scenarios for a client that might be suitable…so don’t feel like ‘Oh I am not expert enough to ever mention the word “charitable,”’ feel like ‘even if I don’t know everything, I can get answers and lots of people will help me get answers — and, by the way, we’re doing something good in the process.’”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Richard Peck, Foundation vice president of development and philanthropy services, at 800-464-6641 ext. 265 or Evpuneq.Crpx@aups.bet.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)