Research consistently shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The 2013 “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series as we enter the end-of-year giving season, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

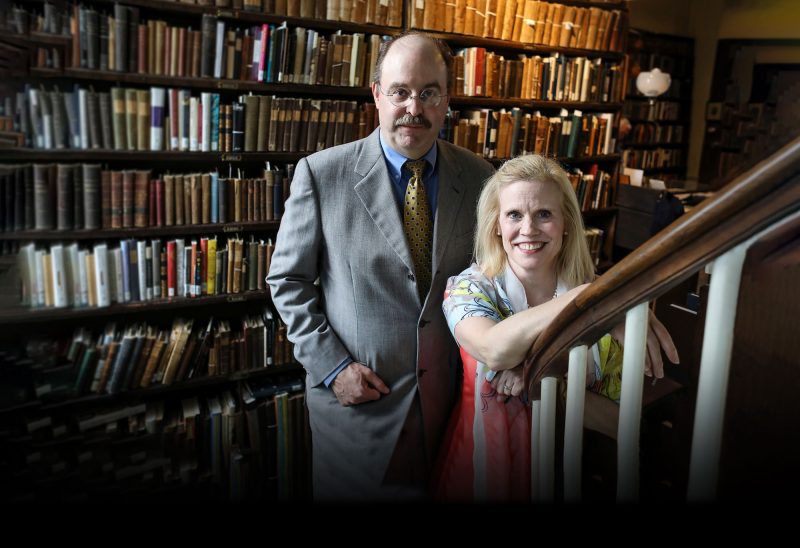

Ken Kinder is a senior investment advisor who recently joined the New Hampshire Charitable Foundation’s board of directors.

Wealth management, he said, has evolved significantly in the past two decades – to become more holistic and less sales- and product-oriented.

“The industry has evolved and the conversation about clients’ financial planning and estate planning has evolved as well,” he said. Now, he said, the work is more conversational – and less strictly transactional.

To manage wealth well, he said, advisors need to understand not just their clients’ assets but also learn about their families and their personal interests.

“And from there, it evolves into a conversation about what their goals and hopes and dreams and aspirations really are,” Kinder said – which may include charitable giving. “The client comes in looking for a holistic view.”

He said that the conversation about charitable giving comes up most frequently during routine reviews of accounts. As part of a well-rounded approach, he said, it is important for advisors to ask their clients about charitable intent.

“It’s a really critical thing to be asking. I think we should be asking a lot more and talking about it a lot more. It’s incumbent on us to try to encourage people to give, and leave money to those things that they are most passionate about as a way of seeing their interests put forth into the future.”

It’s incumbent on us to try to encourage people to give, and leave money to those things that they are most passionate about- Ken KinderTweet This

One possible idea, he said, is to suggest people consider leaving a percentage of their estate to a cause or organization that they feel passionate about.

“When we open accounts, we name beneficiaries on the account…so obviously, the discussion comes up. And I think it would be interesting, during that conversation, to encourage people to consider leaving 15 or 20 percent to something that they’re passionate about.”

Kinder also manages funds for some nonprofit organizations. So he understands the need.

“Nonprofit organizations are often anxious and desperate for monies to fund their operations,” he said. “In particular, I see this with churches…people would give to their church and community much more generously in previous generations.”

“The big question is: how do we help change that?” he asked. “What’s our role in helping change that for the betterment of our society? And I think [advisors] play an important role in that, just in having the conversation…”

Community foundations, like the New Hampshire Charitable Foundation, are increasingly offering an advisor-managed investment option (formerly called individually managed fund) where a person can give assets into a charitable fund held at the Foundation, but which remains under the investment management of their existing advisor. This, Kinder said, should make the charitable giving conversation even easier for advisors to have with their clients.

He would also like to see more collaboration among all the different advisors working with an individual or family.

“There is a conversation that could take place between investment advisors, tax advisors and legal advisors in concert to help fulfill the client’s interest in charitable giving or just to bring in ideas,” he said. “There’s a lot of room there for collaboration.”

He said that, in asking about charitable giving, advisors have a dual opportunity: to help their clients fulfill wishes for their own charitable legacies, and help advance the good works that strengthen communities.

“I am hopeful that these kinds of conversations will increase in frequency,” he said, “and maybe much more positive work can be done.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Richard Peck, Foundation vice president of development and philanthropy services, at 800-464-6641 ext. 265 or Evpuneq.Crpx@aups.bet.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)